Trump’s administration has imposed tariffs on nearly every country around the globe, and that includes even the most remote places such as the Heard Island and McDonald Islands, inhabited with only penguins and seals.

This is the first time the US has applied a standard 10% tariff across the board.

Michael Coon, an associate professor of economics at the University of Tampa, dubs this decision “unusual.”

“The only place you really see something like that is in lower-income countries that don’t have the infrastructure to collect income taxes,” Coon told HuffPost. “It’s easier for them to collect tariffs at the port because you have to set up a customs office on the dock.”

A number of products will be hit by tariffs, and Americans are already experiencing the consequences — in a big way— and it can be seen from the receipts they share.

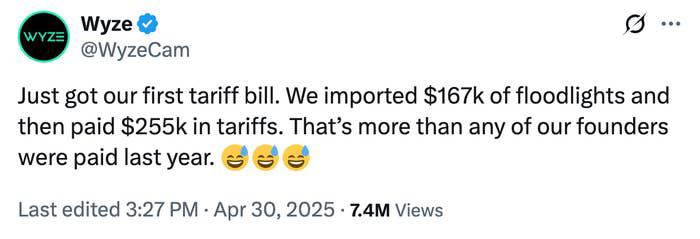

The Washington-based tech firm Wyze Cam posted that they paid “$255,000 in tariffs and $579.23 in ‘other fees’ to import $167,000 of Wyze Cams.”

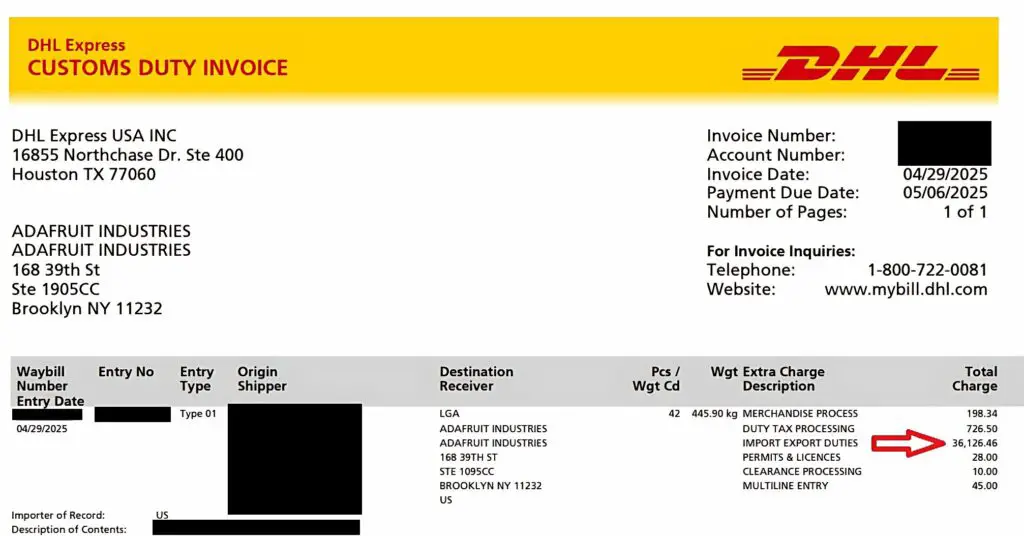

Adafruit Industries said that just like Walmart, they would be forced to increase their prices.

“We’re no stranger to tariff bills, although they have definitely ramped up over the last two months. However, this is our first ‘big bill’, where a large portion was subjected to a 125%+20%+25% import markup,” Adafruit Industries penned.

“Unlike other taxes like sales tax where we collect on behalf of the state and then submit it back at the end of the month, or income taxes, where we only pay if we are profitable, tariff taxes are paid before we sell any of the products and are due within a week of receipt which has a big impact on cash flow.”

Their statement added: “In this particular case, we’re buying from a vendor, not a factory, so we can’t second-source the items (and these particular products we couldn’t manufacture ourselves even if we wanted to, since the vendor has well-deserved IP protections). And the products were booked & manufactured many months ago, before the tariffs were in place.

“Since they are electronics products/components, there’s a chance we may be able to request reclassification on some items to avoid the 125% ‘reciprocal’ tariff, but there’s no assurance that it will succeed, and even if it does, it is many, many months until we could see a refund.”

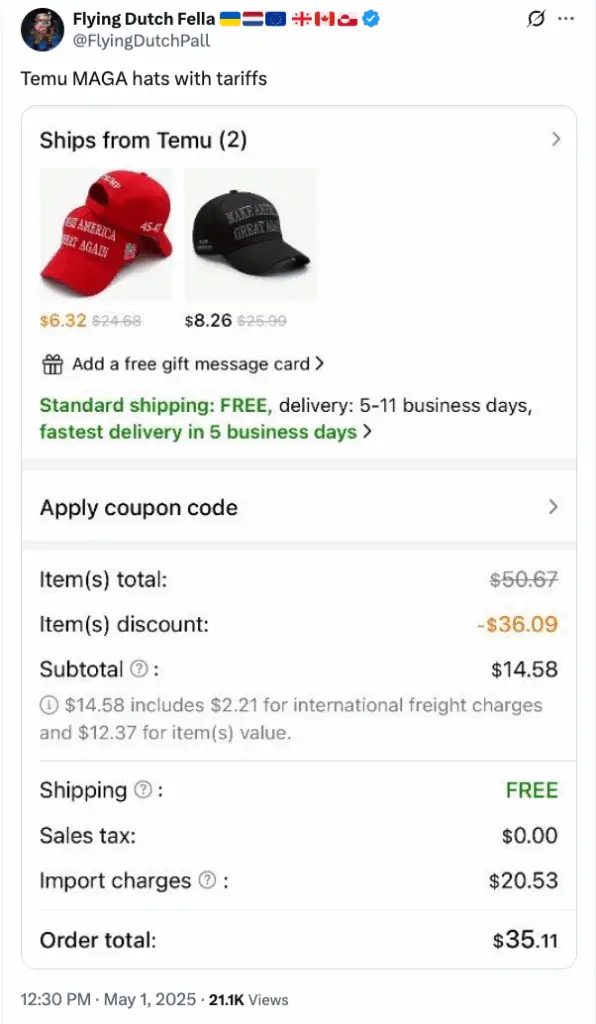

People started sharing their receipts and wonder what the future holds with prices that huge.

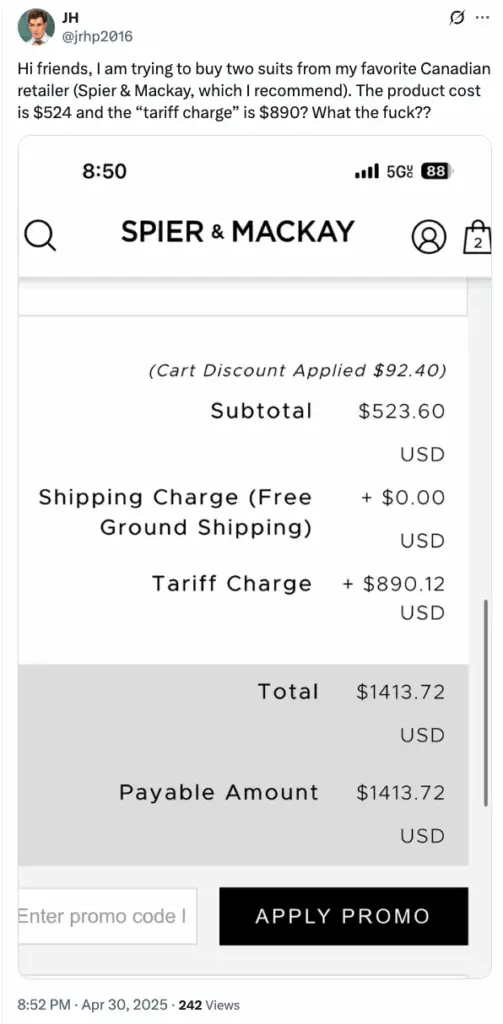

One person complained on the prices for a suit from his favorite Canadian retail store.

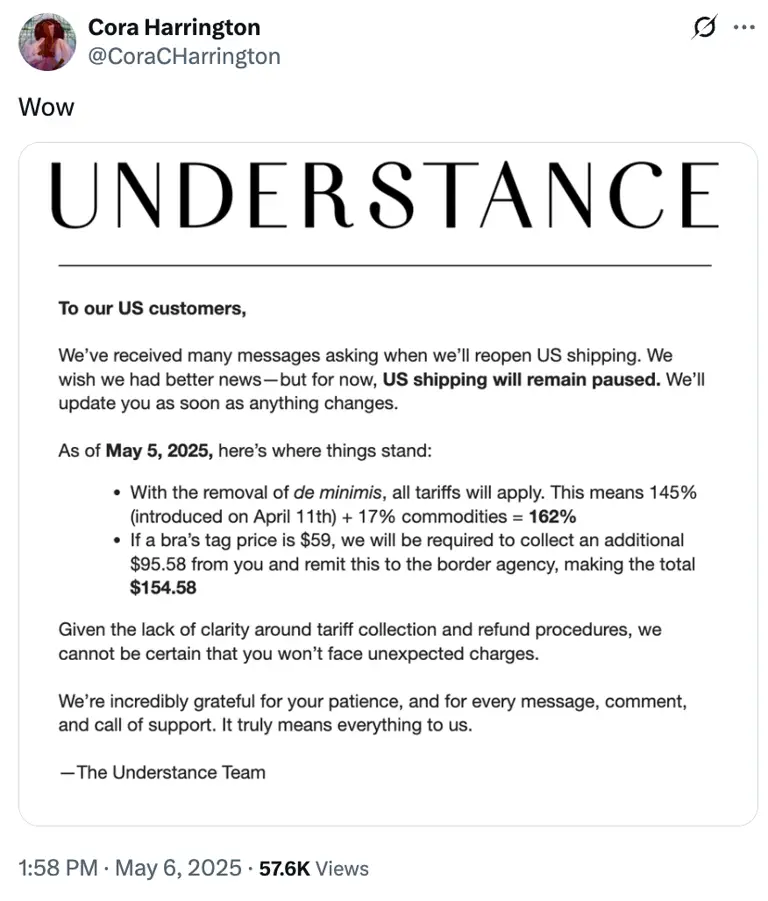

Some businesses even made the decision to pause shipping to the US.

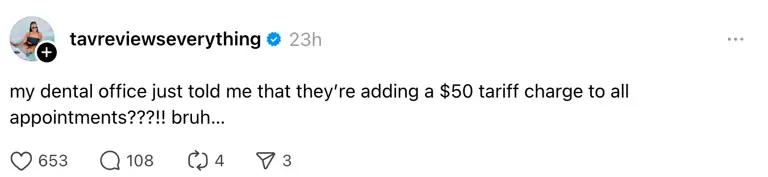

Tariffs are also impacting healthcare.

A Reddit user posted: “A couple of weeks ago, I bought a pre-owned Louis Vuitton wallet from a Japanese seller. The item shipped from Japan. I paid $80 for the wallet, plus US sales tax ($116.91 in total). I just got a notice from DHL that my tariff fees are $83.10!!!”

Please SHARE this article with your family and friends on Facebook.

Bored Daddy

Love and Peace